capital gains tax canada calculator

Canada Capital Gains Tax Calculator 2022. Capital Gains Tax Calculator Real Estate 1031 Exchange.

Taxtips Ca 2021 And 2022 Investment Income Tax Calculator

How Do You Calculate Capital Gains On 2021.

. Our free tool allows you to check your capital gains tax. Short-term capital gain tax or profit from the sale of an asset held for less then a year is taxed at the standard income tax rate. Capital gains tax rates on most assets held for less than a year correspond to.

The total taxable amount for this property is 75000. In Canada 50 of the value of any capital gains is taxable. Calculate your capital gains taxes and average capital gains tax rate for the 2022 tax year.

1 hour agoCapital Gains Are R Capital Gains Is Tax Free In Canada. Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or head of household. The capital gain tax calculator is a quick way to compute the capital gains tax for the tax years 2022 filing in 2023and 2021As you know everything you own as personal or investments- like your home land or household furnishings shares stocks or bonds- will fall under the term capital asset.

How is crypto tax calculated in Canada. 150000 x 50 75000. A good capital gains calculator like ours takes both federal and state taxation into account.

In our example you would have to include 1325 2650 x 50 in your income. Capital gains tax is a tax on the profit when you dispose of an asset that has increased in value. You sell it for 350000 if you intend to buy and hold it.

You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your individual circumstances. Capital gains from a mortgage foreclosure or a conditional sales repossession will be excluded from net income when calculating your claim for the goods and services taxharmonized sales tax credit the Canada child benefit credits allowed under certain related provincial or territorial programs and the age amount. WOWA Trusted and Transparent.

The net gain is taxable in the case where the property was valued at more than 2000 regardless of whether you were taxed at the property 366 days or more 5 percent if you were not taxed at all or 15 if you were. The usual high-income tax suspects California New York Oregon Minnesota New Jersey and Vermont have high taxes on capital gains too. The amount of tax youll pay depends on how much youre earning from other sources.

For instance if you sell a property and make 100000 in profit the capital gains tax rate will only apply to 50000. Use Schedule 3 Capital gains or losses to calculate and report all your capital gains and losses. High net worth individuals and investors may need to consider the implications of capital gains tax on their personal finances and individual wealth management.

250000 100000 150000 total capital gains Since your property is in Canada 50 of the total capital gains profit is subject to tax. New Hampshire doesnt tax income but does tax dividends and interest. Do not include any capital gains or losses in your business or property income even if you used the property for your business.

Canada Capital Gains Tax Calculator 2021 Table of contents Published 10122021 1512 EST Updated 01032022 1203 EST. Forbes Advisors capital gains tax calculator helps estimate the taxes youll pay on profits or losses on sale of assets such as real estate stocks bonds. For more information see Completing Schedule 3.

Use the simple annual Capital Gains Tax Calculator or complete a comprehensive income tax calculation with the annual income tax calculator 2022. It also contains information on how to calculate and report the capital gain or loss resulting from the sale of shares or shares of a flow-through corporation. This capital gains calculator estimates the tax impact of selling your show more instructions.

Only half of the capital gain from any sale will be taxed based on the marginal tax rate which differs between each province. It will also help you estimate the financial value of deferring those taxable gains through a 1031 like-kind exchange Starker exchange instead of a taxable sale. The total capital gains is.

When QSBCS are disposed of in 2020 capital gains deduction limits increase from 441692 per LCGE to 883384 2 times the LCGE. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for more than a year. People will no longer be subject to capital gains tax in 2021 if their total taxable income falls below 40400.

Because in Canada only 50 percent of capital gains are taxable 100000 50000 as only half of these gains qualify for tax. For example you might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto. Capital Gains Tax Canada Rental Property Calculator.

How to Calculate Canada Capital Gains Tax in 5 Steps. Capital Gains Taxes on Property. All capital gains Calculators on iCalculator are updated with the latest Federal and Provincail Tax Rates and Personal Allowances for the 202223.

Taxes On Inherited Property Specifically Capital Gains Tax. Suppose you purchase an property for 250000. Your income tax rate bracket is determined by your net income which is your gross income less any contributions to registered investment accounts.

Long-term capital gains tax profit from the sale of asset or property held a year or longer rates are 0 15 or 20. You can calculate your Annual take home pay based of your Annual Capital Gains Tax Calculator and gross income. How to calculate capital gains tax is to take 50 of the profit add it to your income and calculate the marginal tax rate for that income this will vary by province.

In 2019 capital gains can only exceed 433456 after 2 LCGEs of 866912 12 of an LCGE of 234954. Completing your tax return. The information in this chapter also applies if you filed Form T664 Election to Report a Capital Gain on Property Held at the.

If your income is higher the rate rises to 20 percent. Capital Gains Tax Calculator. A capital gain occurs when you sell or are considered to have sold a capital property for more than the total of its adjusted cost base and the expenses incurred in selling the property.

Each capital gains calculator includes personal tax allowances tax deductions etc and provides a breakdown of your annual salary with Monthly Quarterly Weekly Daily and Hourly pay illustrations. The Canadian Annual Capital Gains Tax Calculator is updated for the 202223 tax year. Those making between 40401 and 445850 are subject to capital gains tax of 15 percent.

The sale price minus your ACB is the capital gain that youll need to pay tax on. The capital gains tax rate in Canada can be calculated by adding the income tax rate in each province with the federal income tax rate and then multiplying by the 50 capital gains inclusion rate. Gains between 350k and 250k 100000 in capital gain.

Capital Gains Tax Calculator For Relative Value Investing

طبيعة ضد للماء مؤسسة Income Tax Calculator Canada Sprungto Com

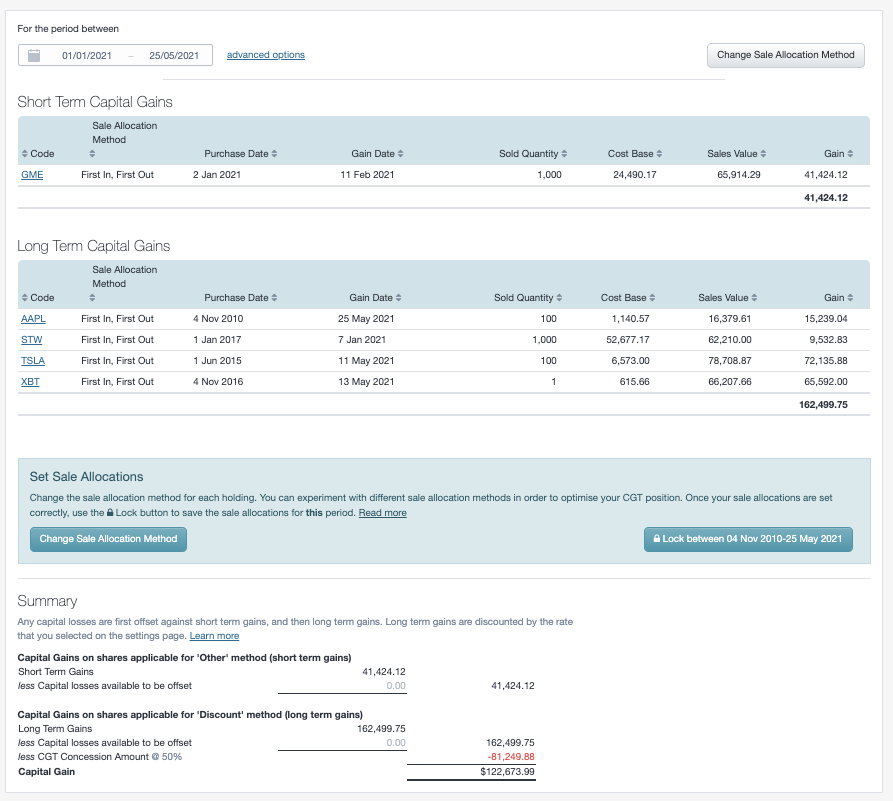

Capital Gains Tax Cgt Calculator For Australian Investors Sharesight

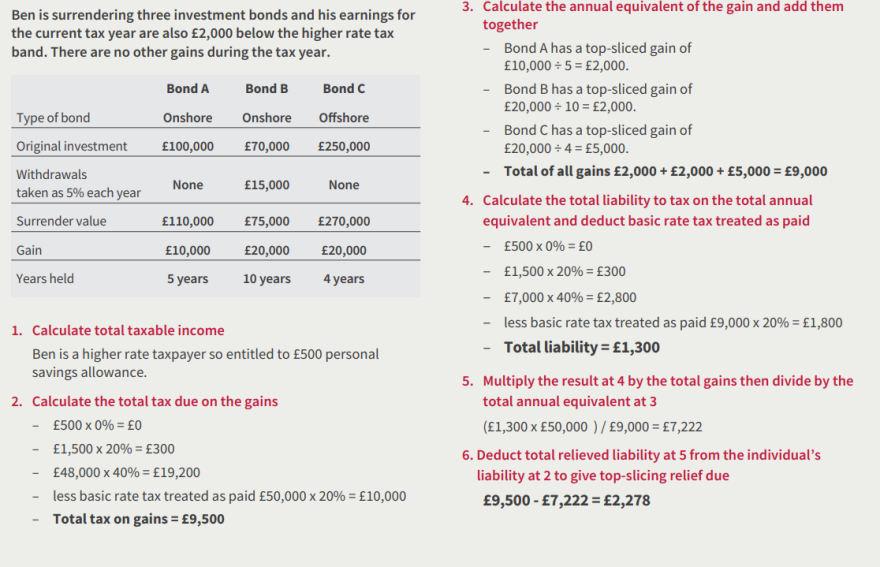

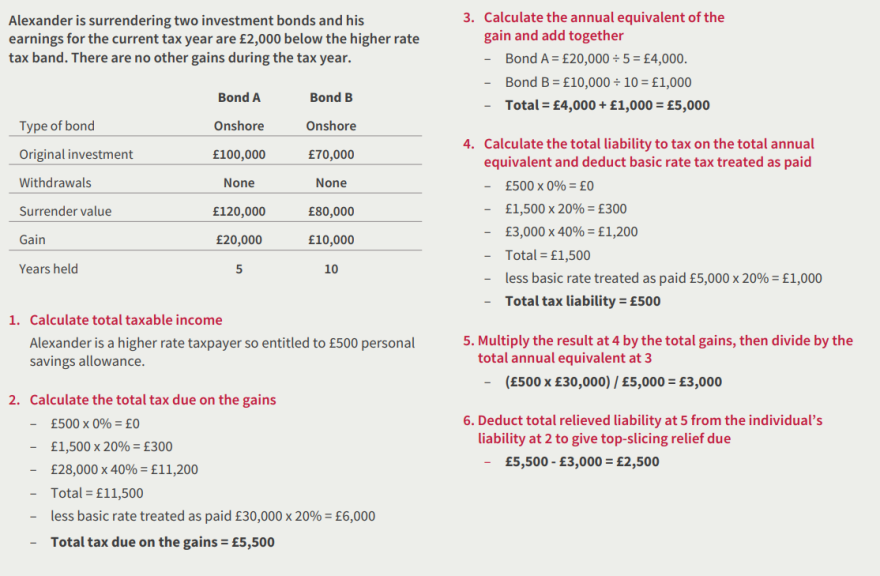

Calculating Multiple Chargeable Gains

Capital Gains Yield Cgy Formula Calculation Example And Guide

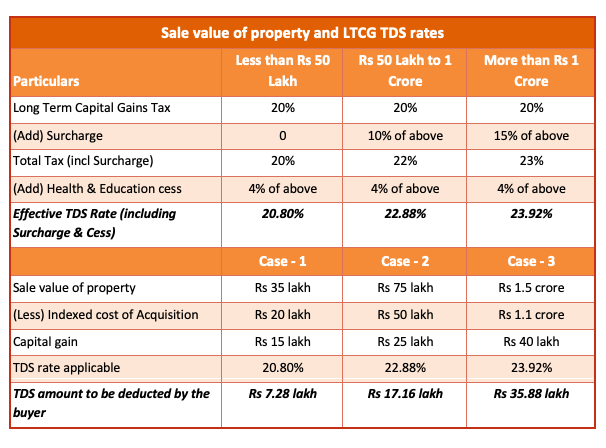

Nri S Complete Guide To Taxes While Selling Property In India Scripbox

Capital Gains Tax Calculator For Relative Value Investing

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

How Do I Calculate Capital Gains On The Sale Of My Home

Calculating Multiple Chargeable Gains

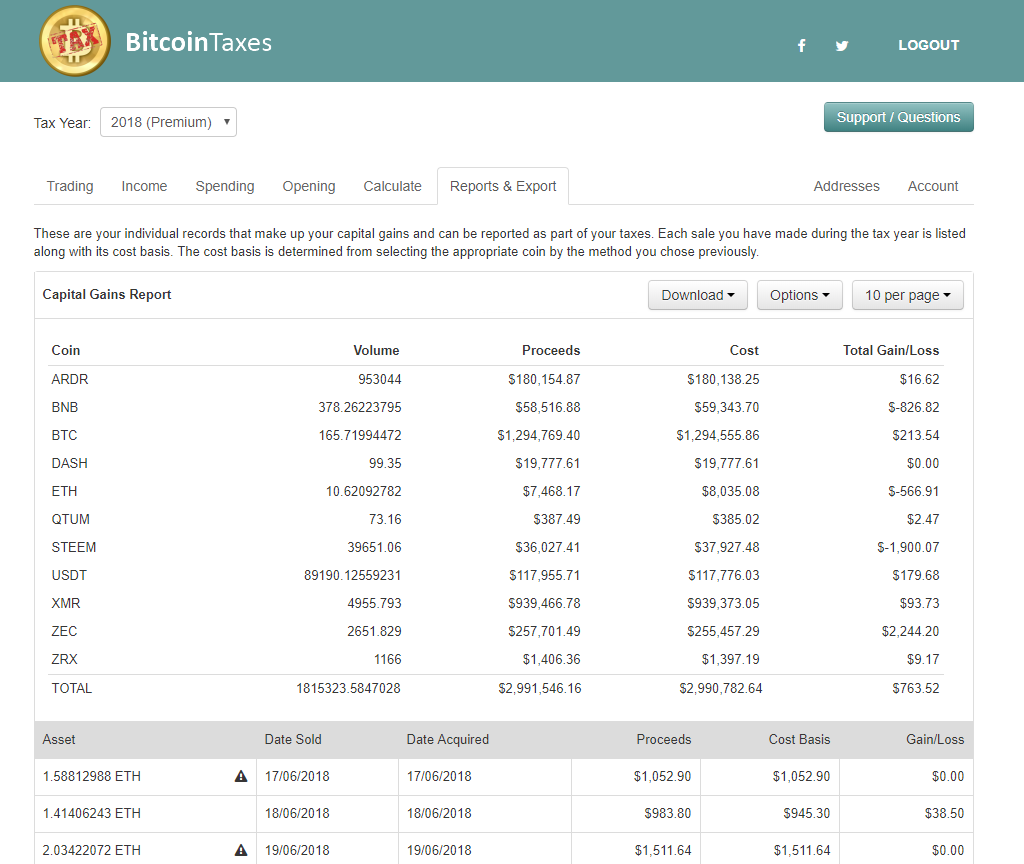

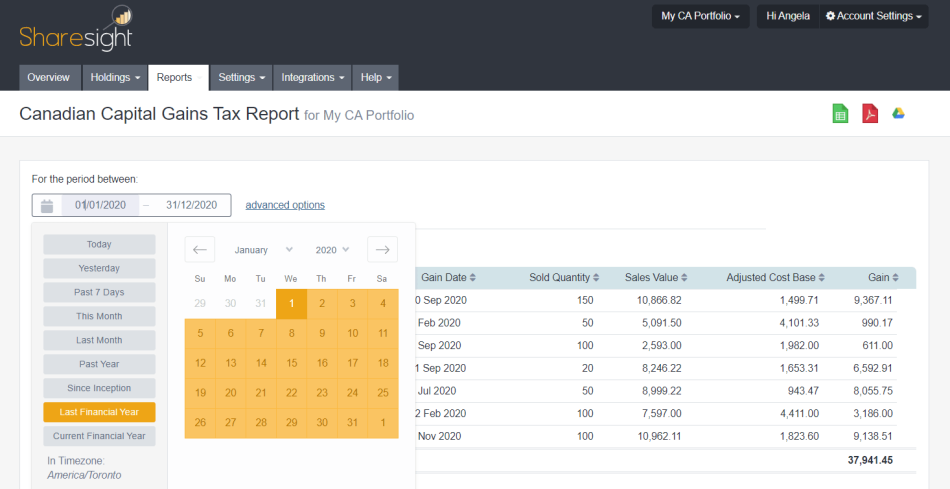

Canadian Capital Gains Tax Report Makes Tax Time Easy Sharesight

Capital Gains 101 How To Calculate Transactions In Foreign Currency

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

Canada Annual Capital Gains Tax Calculator 2022 23 Salary

Capital Gains Definition 2021 Tax Rates And Examples

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Canadian Capital Gains Tax Report Makes Tax Time Easy Sharesight